Green 4

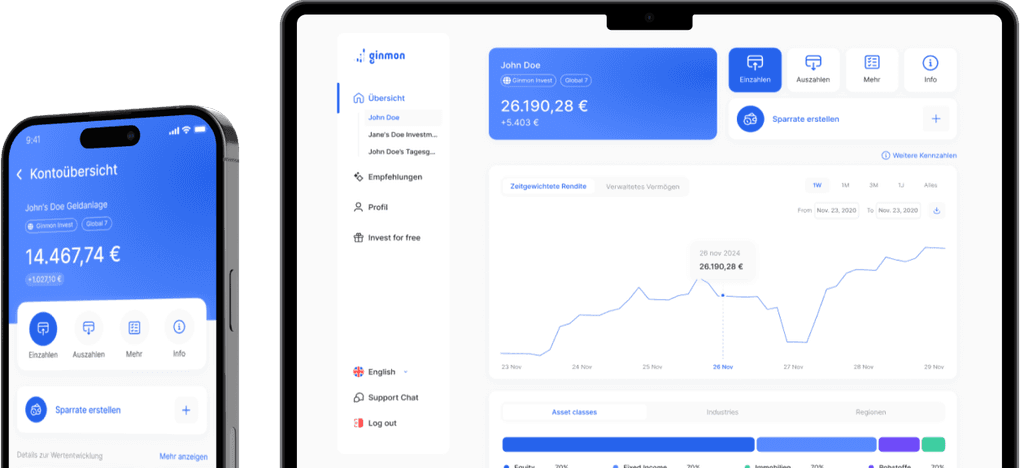

Investment Overview

This strategy combines sustainable bonds and equities in roughly equal proportions and supplements these with property and commodity investments. With a stable structure and a clear focus on ESG criteria, it offers both growth opportunities and financial security for a long-term investment strategy.

Past performance is not indicative of future results. Please read our risk notice here.

Risk metrics

-9.50%

Value at Risk

Value at Risk (VaR) indicates the maximum loss for the strategy that will not be exceeded with a probability of 95% within 12 months.

8.96%

Volatility

Volatility indicates the annualized range of fluctuations in the returns of the strategy.

-12.60%

Maximum Drawdown

Maximum Drawdown (MDD) indicates the largest loss as a percentage that the strategy has incurred from its peak to its trough.

Past performance is not indicative of future results. Please read our risk notice here.

Green Investment

¹ The stated return refers to the historical performance of the investment strategy for the period from 01.01.2016 to 30.09.2024. Please note that investing involves risks and past performance is not a guarantee of future results. The value of your investment may fall or rise. There may be losses of the invested capital. The return figure is after product costs (TER) and before deduction of taxes and service fees.

² Based on "Green 10" strategy and the average carbon emission intensity ("Carbon Emission Intensity Metric Tonnes"). This value results from the sum of the weights of the invested companies, multiplied by their carbon intensity. The carbon intensity is expressed in metric tonnes of CO₂ per million US dollars of revenue. Source: Blackrock 360. Date: 31.10.2024.