Ginmon VL

Invest your VL in ETFs

Receive up to €480 per year from your employer

Capital-forming benefits (VL) with ETFs

No holding or lock-in periods

Recommended by finanztip.de

Received €40 from Volkswagen AG

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

Your ETF solution for VL

Instead of investing in low-interest home savings contracts or bank products with your VL allowance, switch to a high-yield ETF savings plan. A change is possible at any time.

Instead of investing in low-interest home savings contracts or bank products with your VL allowance, switch to a high-yield ETF savings plan. A change is possible at any time.

Invest your VL allowance in a broadly diversified ETF portfolio

Average expected return:

8.66% p.a.¹

No holding or lock-in periods

Intelligent tax optimisation

Also available as a sustainable option

All-inclusive service fee of only 0.75% p.a.

Ginmon VL is available in both classic and sustainable options

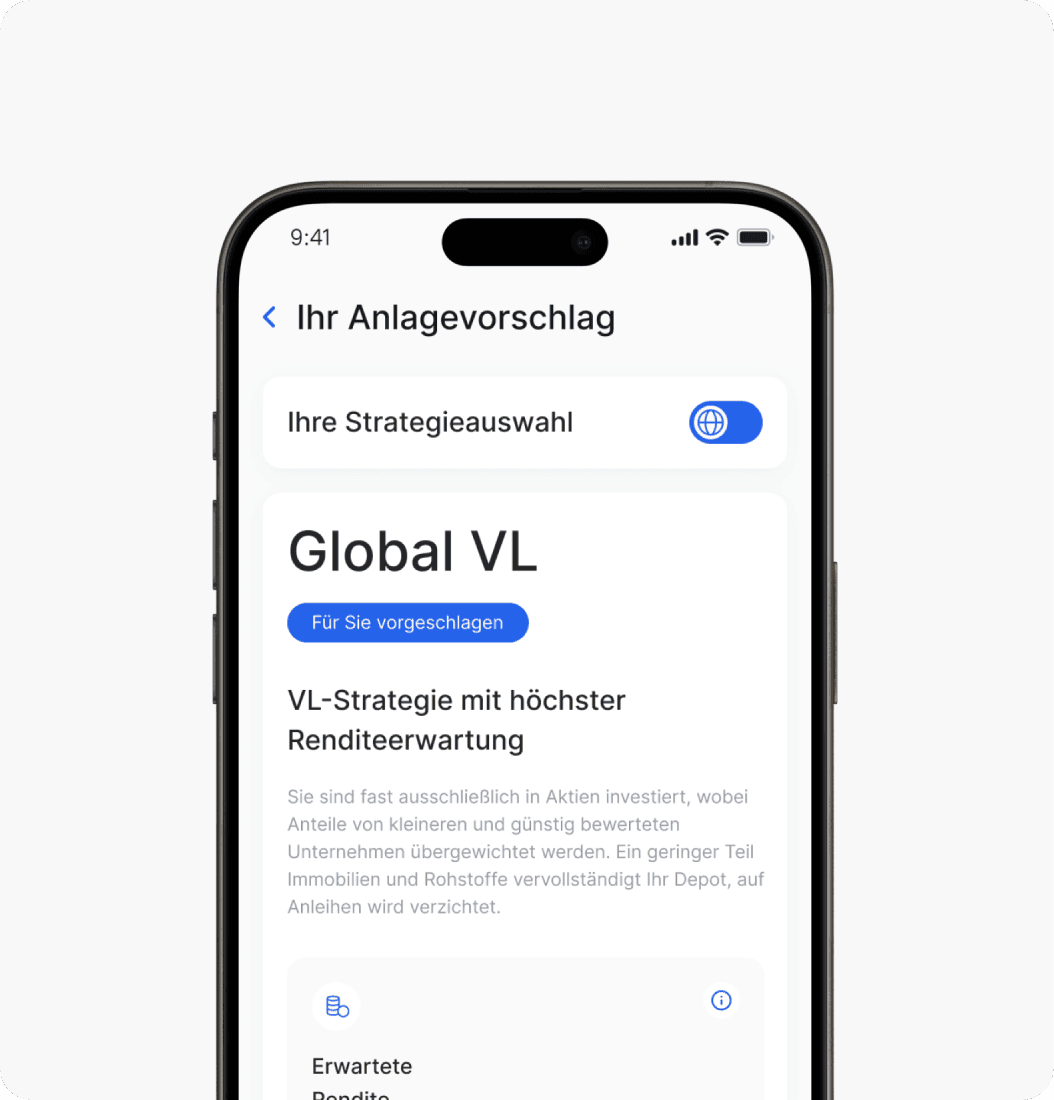

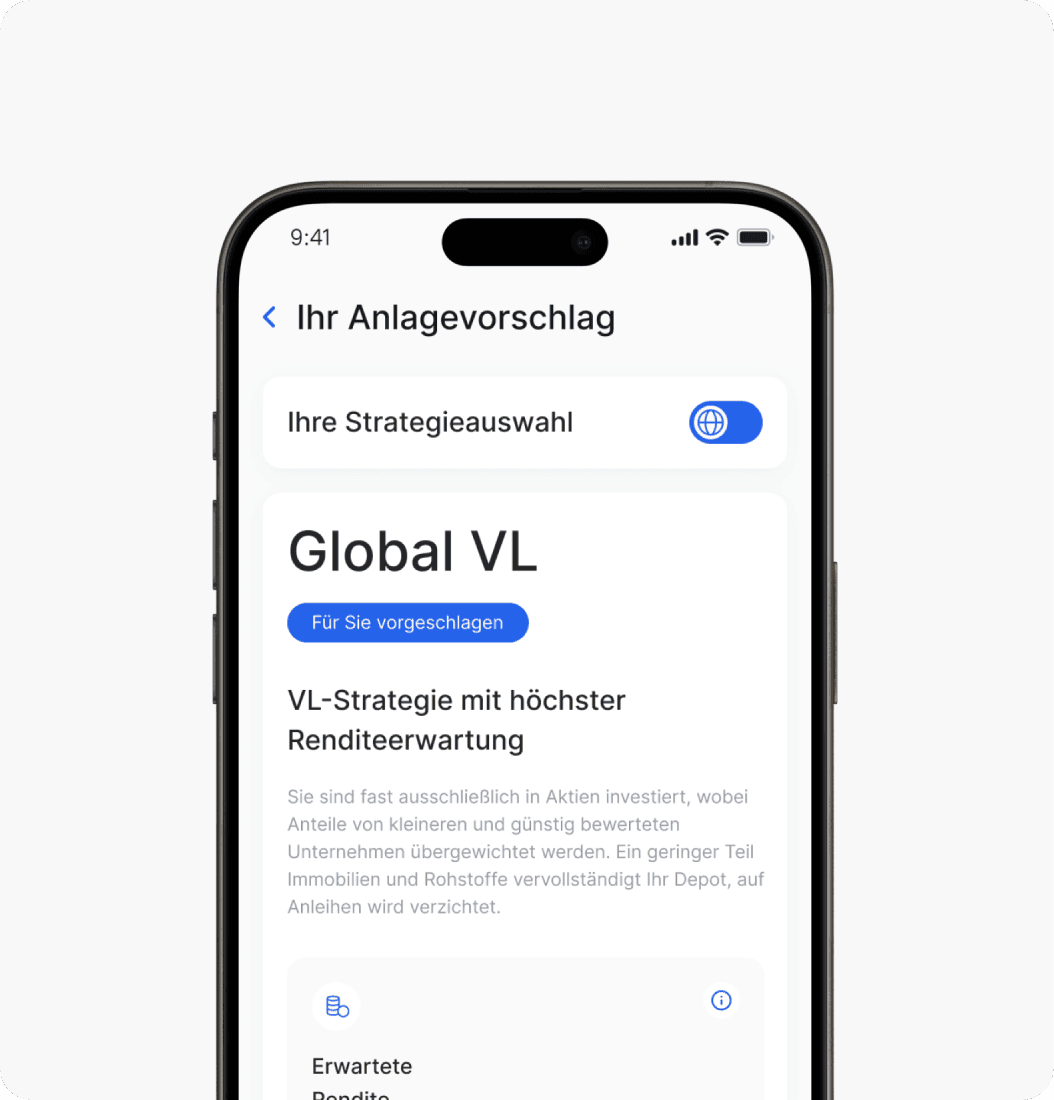

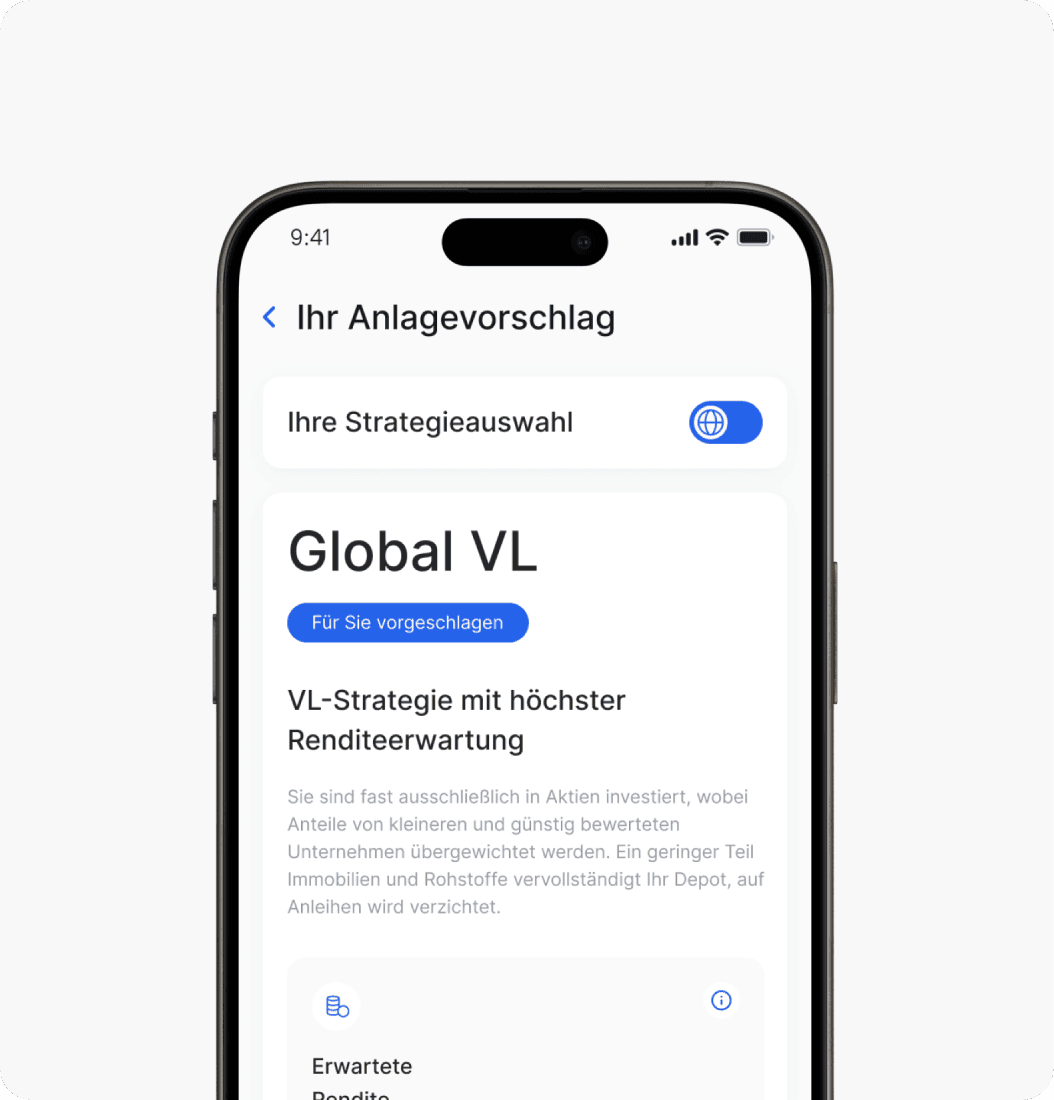

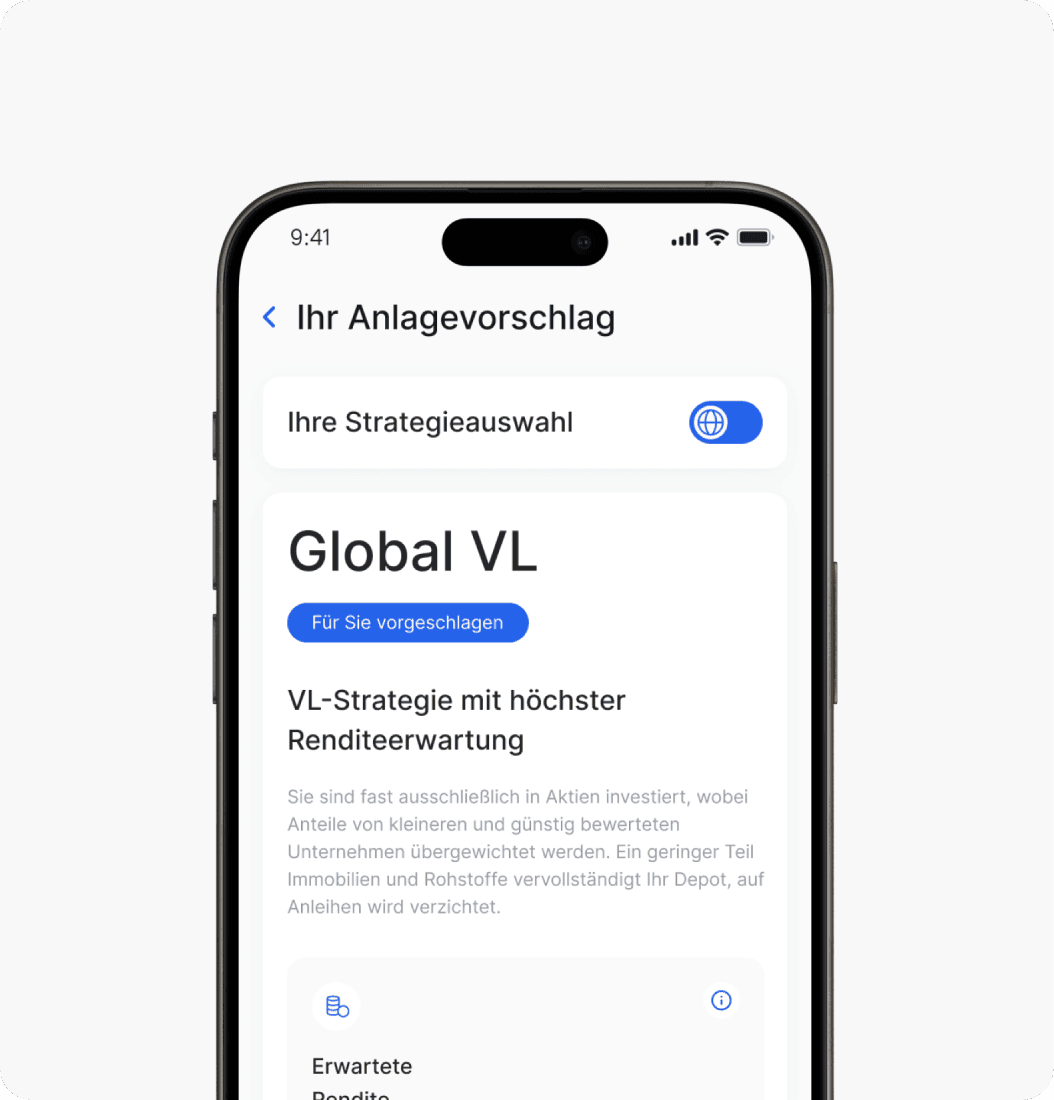

Global VL

Scientific factor investing

Overweighting of value and small caps

GDP-related weighting of world regions

Green VL

Enhanced sustainability approach

Your money is protected

Segregated asset

Your investment is treated as a segregated assets. This means you are 100% protected even if Ginmon or the partner bank becomes insolvent.

EU deposit insurance

In addition, the money you deposit in your settlement account is covered by the EU Deposit Guarantee Scheme and is therefore protected against default risks.

Your money is protected

Segregated asset

Your investment is treated as a segregated assets. This means you are 100% protected even if Ginmon or the partner bank becomes insolvent.

EU deposit insurance

In addition, the money you deposit in your settlement account is covered by the EU Deposit Guarantee Scheme and is therefore protected against default risks.

Your money is protected

Segregated asset

Your investment is treated as a segregated assets. This means you are 100% protected even if Ginmon or the partner bank becomes insolvent.

EU deposit insurance

In addition, the money you deposit in your settlement account is covered by the EU Deposit Guarantee Scheme and is therefore protected against default risks.

Your money is protected

Segregated asset

Your investment is treated as a segregated assets. This means you are 100% protected even if Ginmon or the partner bank becomes insolvent.

EU deposit insurance

In addition, the money you deposit in your settlement account is covered by the EU Deposit Guarantee Scheme and is therefore protected against default risks.

Others

Ginmon

Running costs per year

10 or €20¹

0.75% of the deposit value

Transaction fees

0.2 %

none

ETF fees

dependent on the ETF²

0.26 %

Government funding available

yes

no

Minimum term

7 years

none

Minimum savings amount

per month

none

none

Costs in case of early

termination

€10

none

"Without state funding, there is no required 7-year term at Ginmon – you can cancel at any time free of charge."

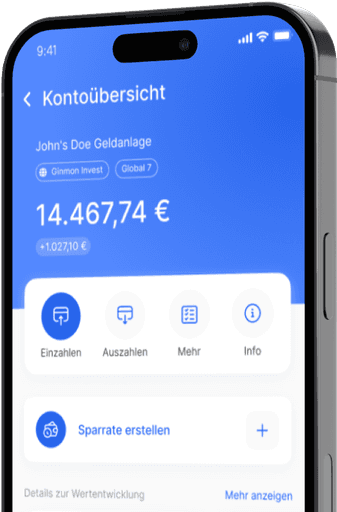

How Ginmon VL works

Step 1

Open Ginmon VL

Answer a short questionnaire, choose an investment strategy, and open an account in just a few minutes.

Step 2

Employer certificate submission

After successful account opening, give your employer the employer certificate, which you can find under your documents.

Step 3

Receive up to €40 per month

Relax and receive your monthly contributions from your employer directly under your VL strategy; Ginmon will invest them automatically for you.

Step 1

Open Ginmon VL

Answer a short questionnaire, choose an investment strategy, and open an account in just a few minutes.

Step 2

Employer certificate submission

After successful account opening, give your employer the employer certificate, which you can find under your documents.

Step 3

Receive up to €40 per month

Relax and receive your monthly contributions from your employer directly under your VL strategy; Ginmon will invest them automatically for you.

Step 1

Open Ginmon VL

Answer a short questionnaire, choose an investment strategy, and open an account in just a few minutes.

Step 2

Employer certificate submission

After successful account opening, give your employer the employer certificate, which you can find under your documents.

Step 3

Receive up to €40 per month

Relax and receive your monthly contributions from your employer directly under your VL strategy; Ginmon will invest them automatically for you.

Step 1

Open Ginmon VL

Answer a short questionnaire, choose an investment strategy, and open an account in just a few minutes.

Step 2

Employer certificate submission

After successful account opening, give your employer the employer certificate, which you can find under your documents.

Step 3

Receive up to €40 per month

Relax and receive your monthly contributions from your employer directly under your VL strategy; Ginmon will invest them automatically for you.

What our customers say

Variable availability of the VL deposit without a 6-year commitment and strong returns.

Martin Hartmann

Great partner for wealth creation. The online opening went smoothly! I am very satisfied with my VL investment.

Momi F

My first choice for a VL depot and their money market fund appeals to me. I have also had very good experiences with the support and have since referred a family member.

sfojackreed

What our customers say

Variable availability of the VL deposit without a 6-year commitment and strong returns.

Martin Hartmann

Great partner for wealth creation. The online opening went smoothly! I am very satisfied with my VL investment.

Momi F

My first choice for a VL depot and their money market fund appeals to me. I have also had very good experiences with the support and have since referred a family member.

sfojackreed

What our customers say

Variable availability of the VL deposit without a 6-year commitment and strong returns.

Martin Hartmann

Great partner for wealth creation. The online opening went smoothly! I am very satisfied with my VL investment.

Momi F

My first choice for a VL depot and their money market fund appeals to me. I have also had very good experiences with the support and have since referred a family member.

sfojackreed

What our customers say

Variable availability of the VL deposit without a 6-year commitment and strong returns.

Martin Hartmann

Great partner for wealth creation. The online opening went smoothly! I am very satisfied with my VL investment.

Momi F

My first choice for a VL depot and their money market fund appeals to me. I have also had very good experiences with the support and have since referred a family member.

sfojackreed

Any questions?

What are capital-forming benefits?

Capital-forming benefits (VL or VWL) are cash benefits from the employer, either on a voluntary basis or based on a regulation in the collective or employment contract. The money gift from the employer must be paid into a specific form of investment.

The employer can add up to €40 per month to your gross salary. Whether and how much your employer pays is usually regulated in the employment or collective agreement

What is the advantage of an ETF savings plan over building loan contracts / bank deposits?

Due to the current interest rate situation, building loan contracts and bank deposits hardly yield any returns. It is therefore advisable to invest the capital-forming benefits on the capital market, as is the case with Ginmon. After all, your savings should continue to increase in the long term.

What are the total costs that I will incur?

Your total costs relate to your respective portfolio volume and are calculated from:

The All-In Service Fee (0.75% p.a.)

+ ETF Fee of the respective fund provider (Global Strategy: 0.17% p.a. or Green Strategy: 0.23% p.a.)

In total, you will always pay less than 1 % p.a.! You will not incur any additional costs (e.g., for opening an account, closing an account, etc.)

What do I have to do to start?

To find out if you receive capital-forming benefits, check with your human resources department or check your employment or collective agreement.

If your employer pays you VL, open your VL account with Ginmon. After opening an account, you will automatically receive a document on which you will find the IBAN of the account.

You pass this document on to your employer and let the VL payments go to your deposit.

I already have a VL contract but would prefer to use Ginmon VL

You can easily change your VL contract.

You inform your employer that the capital-forming benefits should now be paid into Ginmon VL. You will, of course, receive written notification of this from us.

In this case, the first VL contract is no longer saved and the capital-forming benefits are credited to Ginmon VL. You can have the old VL contract paid out after the blocking period has expired.

What happens to the VL account when changing employers?

You can easily transfer the capital-forming benefit payments to your new employer.

If your new employer does not offer any capital-forming benefits, you can ask your employer to pay the other contributions from your net salary into the VL account. Our service is always ready to support you.

Any questions?

What are capital-forming benefits?

Capital-forming benefits (VL or VWL) are cash benefits from the employer, either on a voluntary basis or based on a regulation in the collective or employment contract. The money gift from the employer must be paid into a specific form of investment.

The employer can add up to €40 per month to your gross salary. Whether and how much your employer pays is usually regulated in the employment or collective agreement

What is the advantage of an ETF savings plan over building loan contracts / bank deposits?

Due to the current interest rate situation, building loan contracts and bank deposits hardly yield any returns. It is therefore advisable to invest the capital-forming benefits on the capital market, as is the case with Ginmon. After all, your savings should continue to increase in the long term.

What are the total costs that I will incur?

Your total costs relate to your respective portfolio volume and are calculated from:

The All-In Service Fee (0.75% p.a.)

+ ETF Fee of the respective fund provider (Global Strategy: 0.17% p.a. or Green Strategy: 0.23% p.a.)

In total, you will always pay less than 1 % p.a.! You will not incur any additional costs (e.g., for opening an account, closing an account, etc.)

What do I have to do to start?

To find out if you receive capital-forming benefits, check with your human resources department or check your employment or collective agreement.

If your employer pays you VL, open your VL account with Ginmon. After opening an account, you will automatically receive a document on which you will find the IBAN of the account.

You pass this document on to your employer and let the VL payments go to your deposit.

I already have a VL contract but would prefer to use Ginmon VL

You can easily change your VL contract.

You inform your employer that the capital-forming benefits should now be paid into Ginmon VL. You will, of course, receive written notification of this from us.

In this case, the first VL contract is no longer saved and the capital-forming benefits are credited to Ginmon VL. You can have the old VL contract paid out after the blocking period has expired.

What happens to the VL account when changing employers?

You can easily transfer the capital-forming benefit payments to your new employer.

If your new employer does not offer any capital-forming benefits, you can ask your employer to pay the other contributions from your net salary into the VL account. Our service is always ready to support you.

Any questions?

What are capital-forming benefits?

Capital-forming benefits (VL or VWL) are cash benefits from the employer, either on a voluntary basis or based on a regulation in the collective or employment contract. The money gift from the employer must be paid into a specific form of investment.

The employer can add up to €40 per month to your gross salary. Whether and how much your employer pays is usually regulated in the employment or collective agreement

What is the advantage of an ETF savings plan over building loan contracts / bank deposits?

Due to the current interest rate situation, building loan contracts and bank deposits hardly yield any returns. It is therefore advisable to invest the capital-forming benefits on the capital market, as is the case with Ginmon. After all, your savings should continue to increase in the long term.

What are the total costs that I will incur?

Your total costs relate to your respective portfolio volume and are calculated from:

The All-In Service Fee (0.75% p.a.)

+ ETF Fee of the respective fund provider (Global Strategy: 0.17% p.a. or Green Strategy: 0.23% p.a.)

In total, you will always pay less than 1 % p.a.! You will not incur any additional costs (e.g., for opening an account, closing an account, etc.)

What do I have to do to start?

To find out if you receive capital-forming benefits, check with your human resources department or check your employment or collective agreement.

If your employer pays you VL, open your VL account with Ginmon. After opening an account, you will automatically receive a document on which you will find the IBAN of the account.

You pass this document on to your employer and let the VL payments go to your deposit.

I already have a VL contract but would prefer to use Ginmon VL

You can easily change your VL contract.

You inform your employer that the capital-forming benefits should now be paid into Ginmon VL. You will, of course, receive written notification of this from us.

In this case, the first VL contract is no longer saved and the capital-forming benefits are credited to Ginmon VL. You can have the old VL contract paid out after the blocking period has expired.

What happens to the VL account when changing employers?

You can easily transfer the capital-forming benefit payments to your new employer.

If your new employer does not offer any capital-forming benefits, you can ask your employer to pay the other contributions from your net salary into the VL account. Our service is always ready to support you.

Any questions?

What are capital-forming benefits?

Capital-forming benefits (VL or VWL) are cash benefits from the employer, either on a voluntary basis or based on a regulation in the collective or employment contract. The money gift from the employer must be paid into a specific form of investment.

The employer can add up to €40 per month to your gross salary. Whether and how much your employer pays is usually regulated in the employment or collective agreement

What is the advantage of an ETF savings plan over building loan contracts / bank deposits?

Due to the current interest rate situation, building loan contracts and bank deposits hardly yield any returns. It is therefore advisable to invest the capital-forming benefits on the capital market, as is the case with Ginmon. After all, your savings should continue to increase in the long term.

What are the total costs that I will incur?

Your total costs relate to your respective portfolio volume and are calculated from:

The All-In Service Fee (0.75% p.a.)

+ ETF Fee of the respective fund provider (Global Strategy: 0.17% p.a. or Green Strategy: 0.23% p.a.)

In total, you will always pay less than 1 % p.a.! You will not incur any additional costs (e.g., for opening an account, closing an account, etc.)

What do I have to do to start?

To find out if you receive capital-forming benefits, check with your human resources department or check your employment or collective agreement.

If your employer pays you VL, open your VL account with Ginmon. After opening an account, you will automatically receive a document on which you will find the IBAN of the account.

You pass this document on to your employer and let the VL payments go to your deposit.

I already have a VL contract but would prefer to use Ginmon VL

You can easily change your VL contract.

You inform your employer that the capital-forming benefits should now be paid into Ginmon VL. You will, of course, receive written notification of this from us.

In this case, the first VL contract is no longer saved and the capital-forming benefits are credited to Ginmon VL. You can have the old VL contract paid out after the blocking period has expired.

What happens to the VL account when changing employers?

You can easily transfer the capital-forming benefit payments to your new employer.

If your new employer does not offer any capital-forming benefits, you can ask your employer to pay the other contributions from your net salary into the VL account. Our service is always ready to support you.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

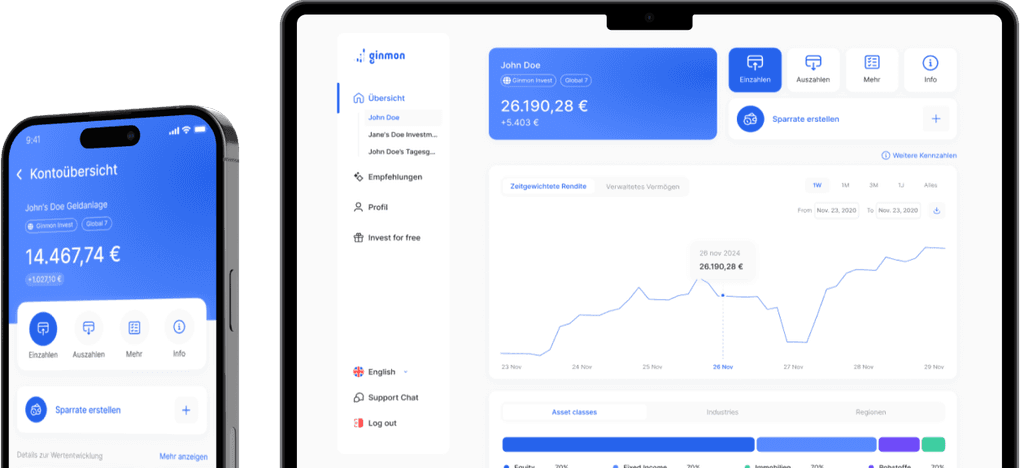

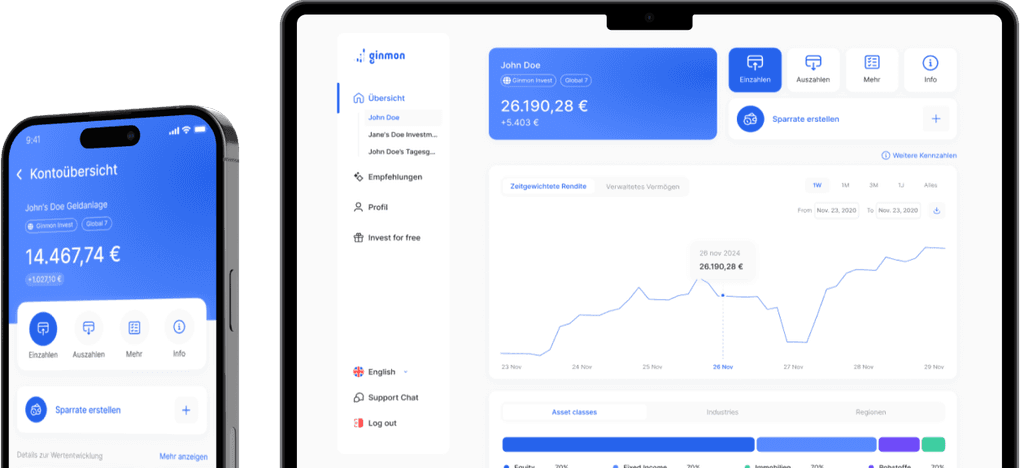

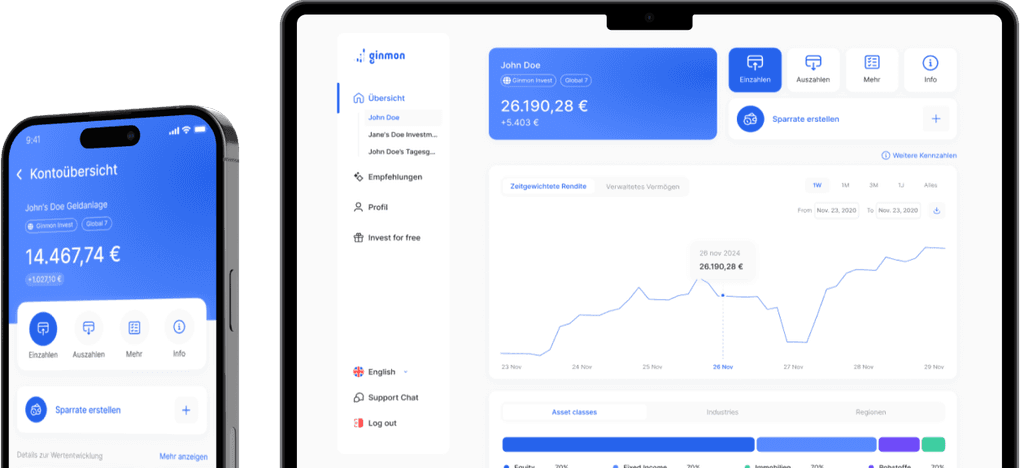

Get the app

⁴ Customer reviews come from Trustpilot or Google Reviews. Verification is not done by Ginmon, but by the respective review platforms. For more information on how these providers ensure the authenticity of reviews, you can find it here: Trustpilot / Google.