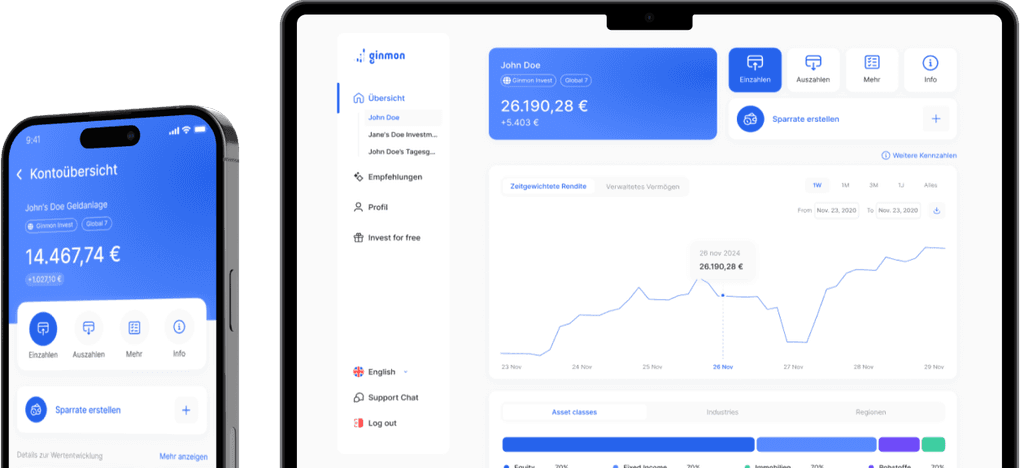

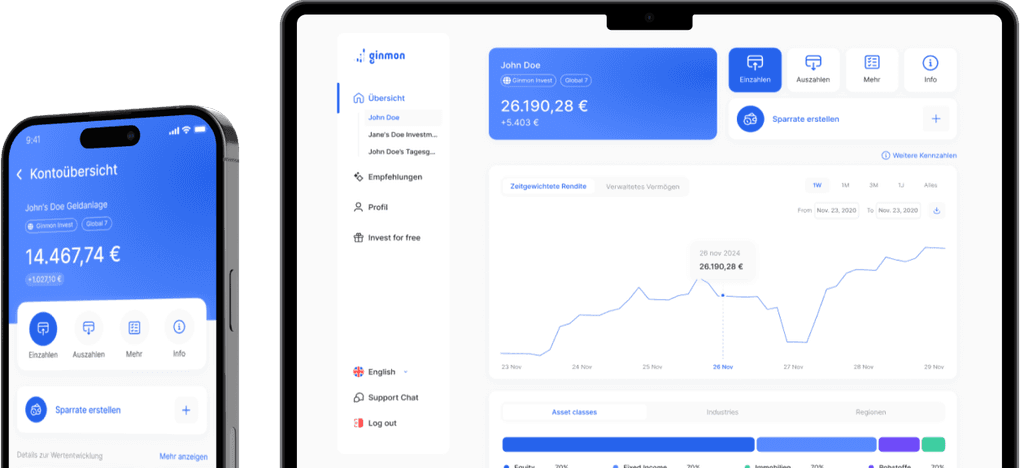

Ginmon Motive

Invest in attractive trends and themes

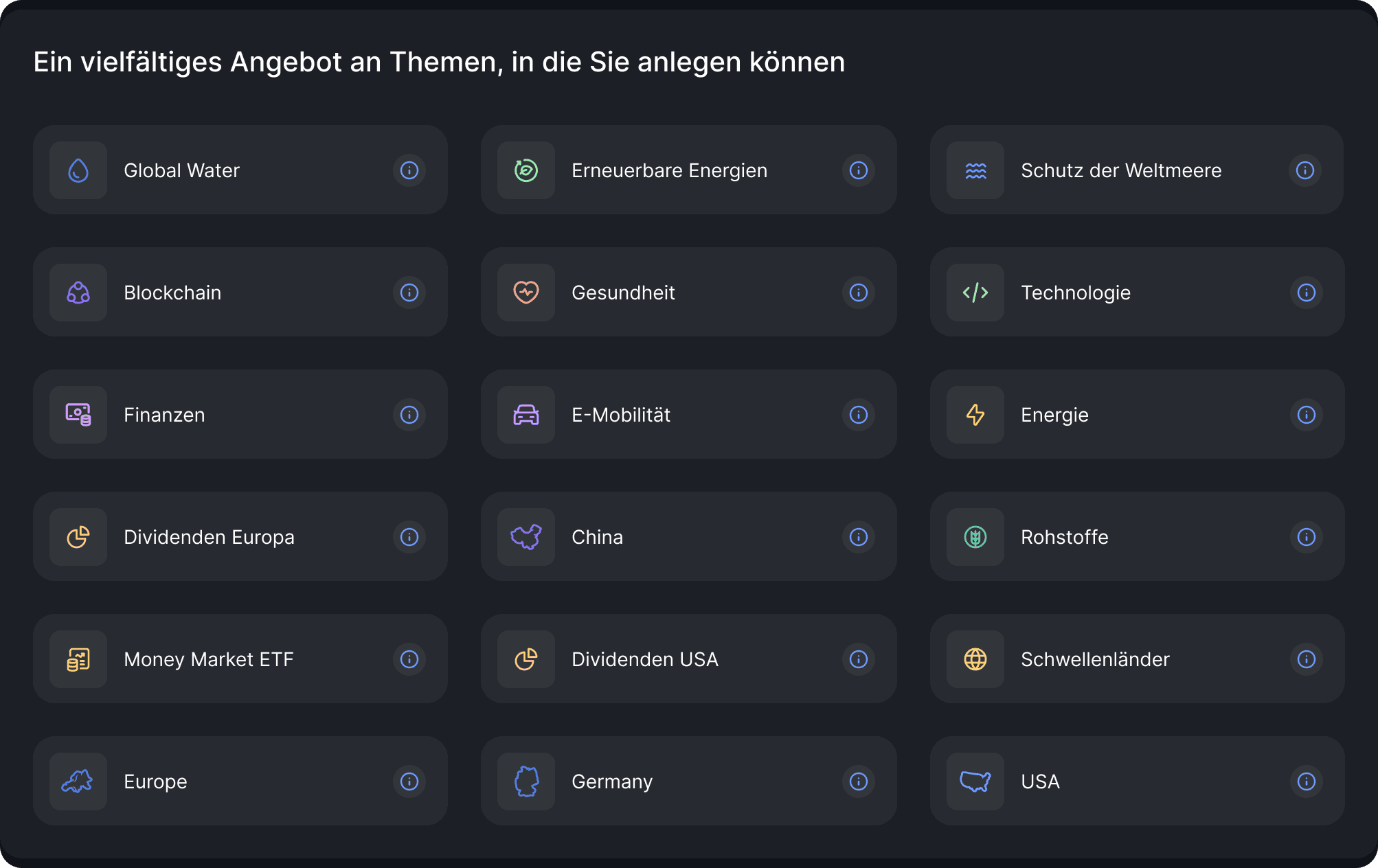

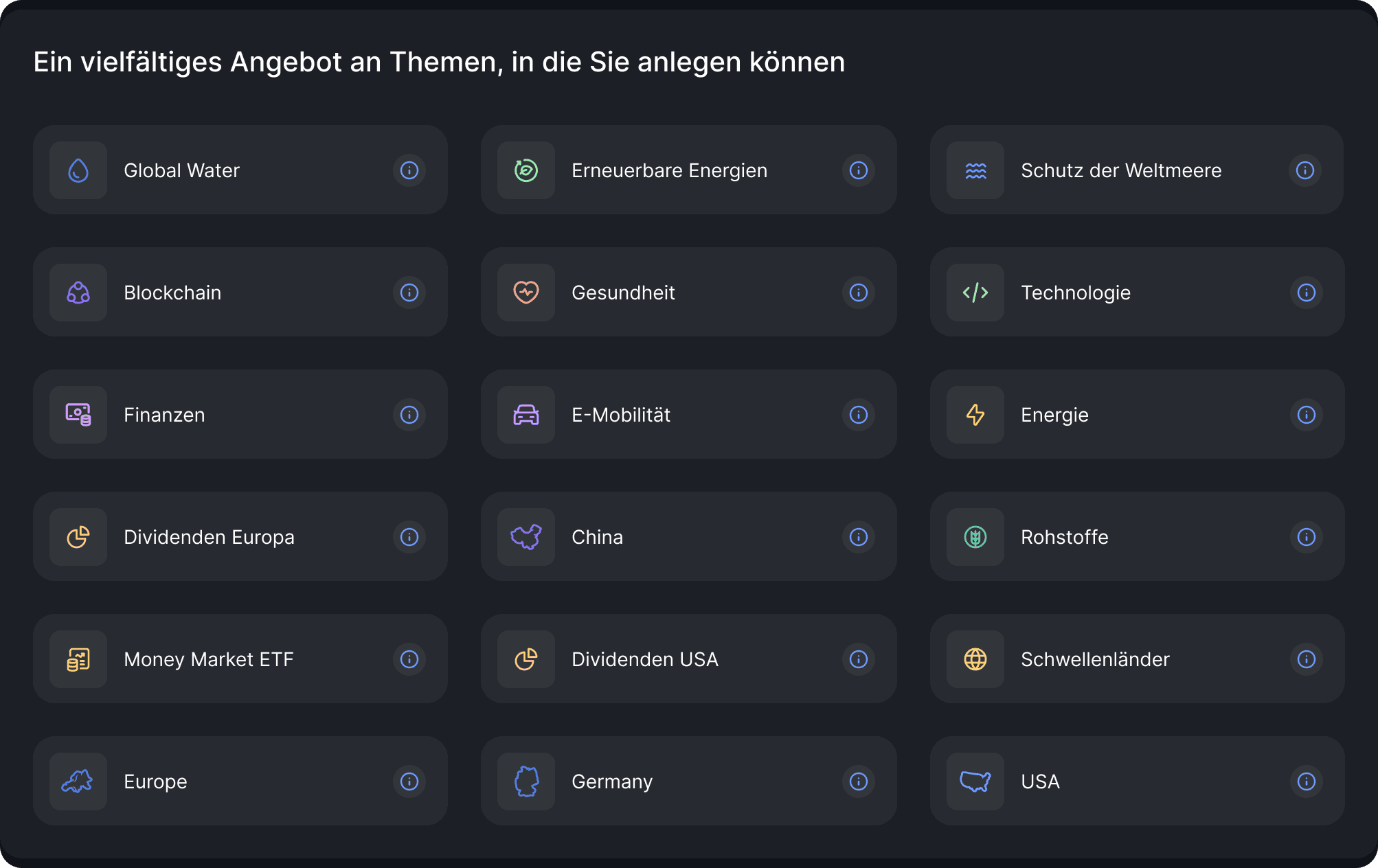

18 different investment themes available

Automatic selection of the best ETFs

Allows customisation of your investment

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

on Google & Trustpilot

€400M

Assets Under Management

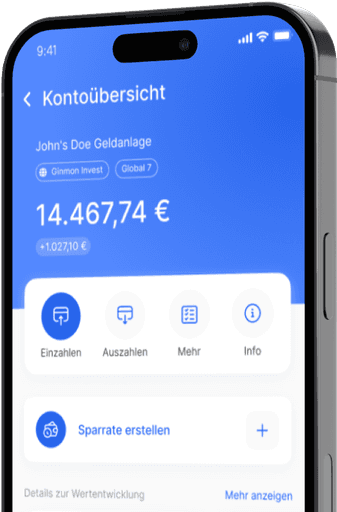

Your individual interests are the priority

Ginmon scans the market to filter out the best ETFs for promising trends. You decide in which ones to invest.

18 different trends available

Invest individually or combine them

A flat service fee starting from 0.60% p.a.

Investing in individual trends, countries, or industries

Build a portfolio with up to 18 different themes

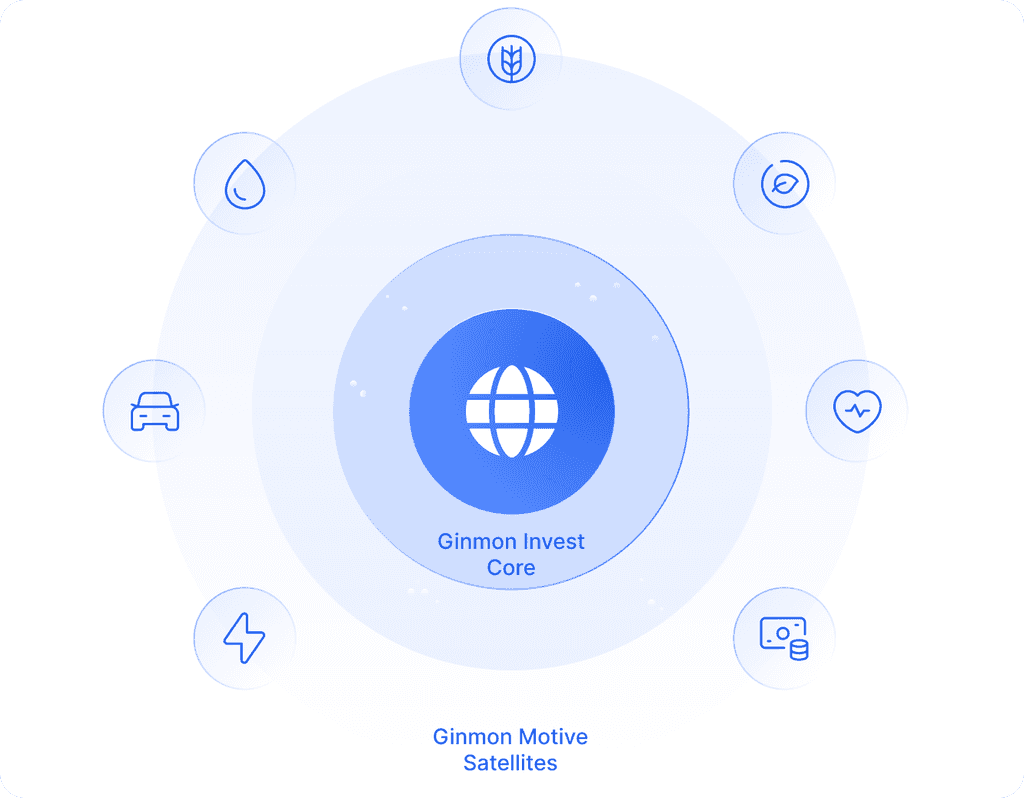

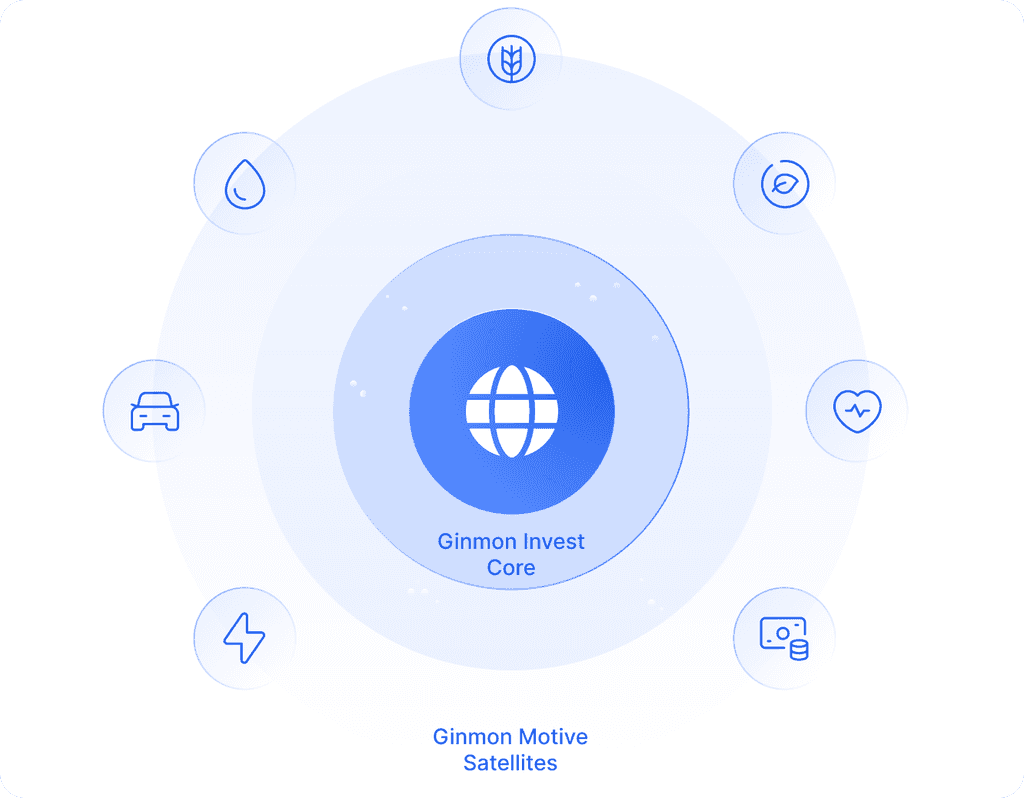

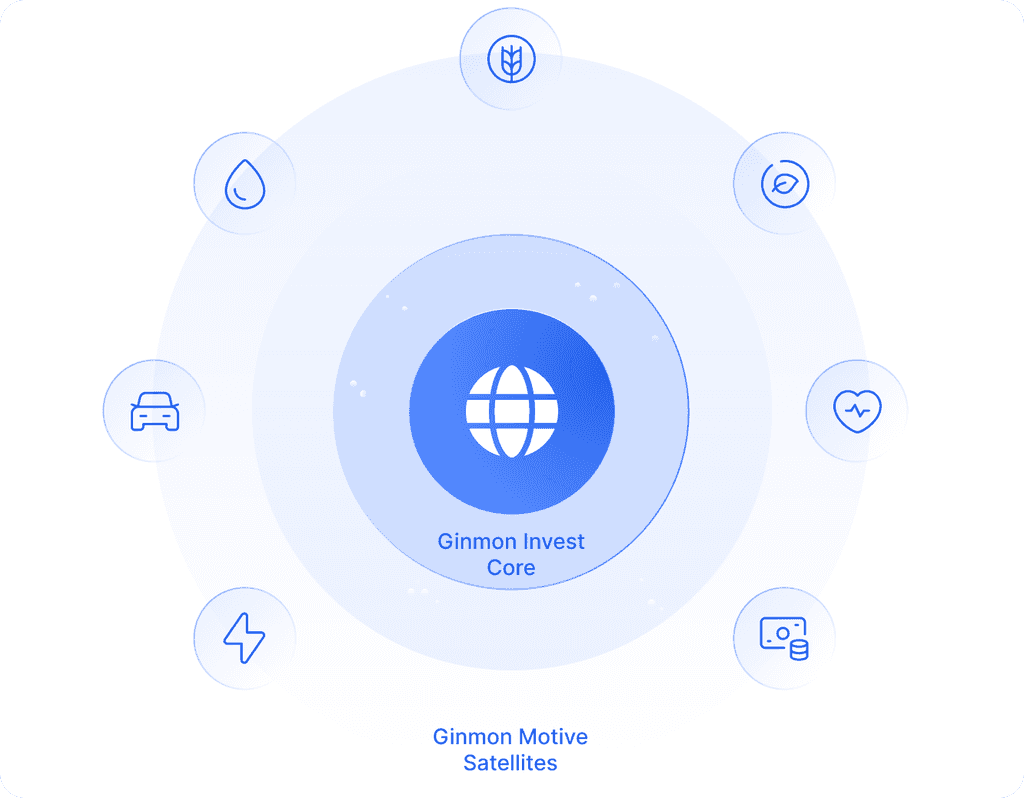

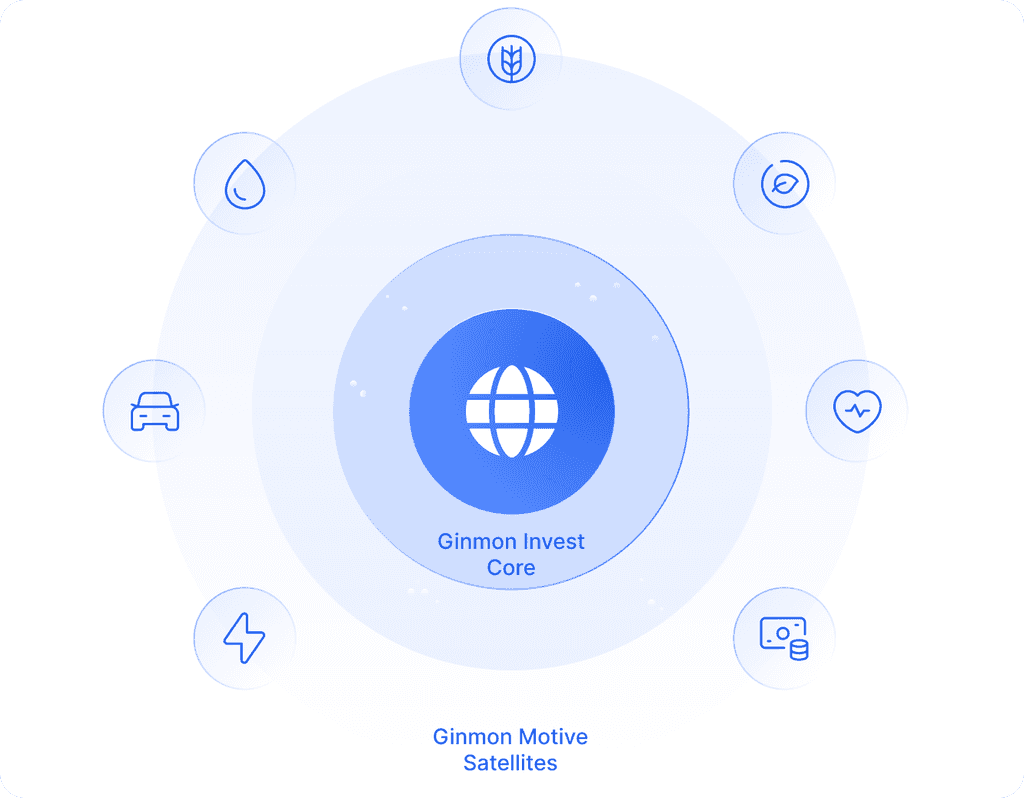

Core-Satellite Strategy

Ginmon Motive is ideal for implementing a core-satellite strategy. In this approach, the majority of your assets are invested in a broadly diversified core strategy (e.g. Ginmon Invest), while individual themes are added to complement and selectively overweight specific areas.

What our customers say

Don’t worry about anything, just determine your risk profile and invest. Simple, low-cost investment. I also liked the recent excellent returns.

Christoph Decker

Four years ago, I entered the world of robo-advisors. It has been a very rewarding experience with a remarkable return on my investment.

Stephan Weber

The independence from a large investment group is a big plus. I also tried the market leader, but I was very unsatisfied with it.

Eduard Hoffman

What our customers say

Don’t worry about anything, just determine your risk profile and invest. Simple, low-cost investment. I also liked the recent excellent returns.

Christoph Decker

Four years ago, I entered the world of robo-advisors. It has been a very rewarding experience with a remarkable return on my investment.

Stephan Weber

The independence from a large investment group is a big plus. I also tried the market leader, but I was very unsatisfied with it.

Eduard Hoffman

What our customers say

Don’t worry about anything, just determine your risk profile and invest. Simple, low-cost investment. I also liked the recent excellent returns.

Christoph Decker

Four years ago, I entered the world of robo-advisors. It has been a very rewarding experience with a remarkable return on my investment.

Stephan Weber

The independence from a large investment group is a big plus. I also tried the market leader, but I was very unsatisfied with it.

Eduard Hoffman

Any questions?

What fees apply?

The standard Ginmon all-in service fee of 0.75% p.a. applies to Ginmon Motive. In addition, ETF costs (TER) are incurred, which are deducted directly from the fund assets by the ETF providers.

How much money should be invested in Ginmon Motive?

We recommend using Ginmon Motive as part of a "Core-Satellite" strategy. The majority of capital investments, usually at least 80%, should be made through long-term manageable "Core" investments.

For this purpose, Ginmon Invest is suitable, for example. Ginmon Motive should rather be viewed as a speculative investment and should therefore not exceed a weight of 20% in the overall portfolio as a "Satellite".

Is an investment in Ginmon Motive suitable?

Investments in certain themes are of interest to anyone who follows current developments or wishes to invest specifically in their interests. In this context, the personal risk profile plays an important role. Ginmon strategies are associated with higher risk and greater volatility, which can lead to larger fluctuations in the portfolio value. These fluctuations may not be suitable for every investor. For private retirement provision or long-term wealth accumulation, Ginmon strategies are not recommended.

Any questions?

What fees apply?

The standard Ginmon all-in service fee of 0.75% p.a. applies to Ginmon Motive. In addition, ETF costs (TER) are incurred, which are deducted directly from the fund assets by the ETF providers.

How much money should be invested in Ginmon Motive?

We recommend using Ginmon Motive as part of a "Core-Satellite" strategy. The majority of capital investments, usually at least 80%, should be made through long-term manageable "Core" investments.

For this purpose, Ginmon Invest is suitable, for example. Ginmon Motive should rather be viewed as a speculative investment and should therefore not exceed a weight of 20% in the overall portfolio as a "Satellite".

Is an investment in Ginmon Motive suitable?

Investments in certain themes are of interest to anyone who follows current developments or wishes to invest specifically in their interests. In this context, the personal risk profile plays an important role. Ginmon strategies are associated with higher risk and greater volatility, which can lead to larger fluctuations in the portfolio value. These fluctuations may not be suitable for every investor. For private retirement provision or long-term wealth accumulation, Ginmon strategies are not recommended.

Any questions?

What fees apply?

The standard Ginmon all-in service fee of 0.75% p.a. applies to Ginmon Motive. In addition, ETF costs (TER) are incurred, which are deducted directly from the fund assets by the ETF providers.

How much money should be invested in Ginmon Motive?

We recommend using Ginmon Motive as part of a "Core-Satellite" strategy. The majority of capital investments, usually at least 80%, should be made through long-term manageable "Core" investments.

For this purpose, Ginmon Invest is suitable, for example. Ginmon Motive should rather be viewed as a speculative investment and should therefore not exceed a weight of 20% in the overall portfolio as a "Satellite".

Is an investment in Ginmon Motive suitable?

Investments in certain themes are of interest to anyone who follows current developments or wishes to invest specifically in their interests. In this context, the personal risk profile plays an important role. Ginmon strategies are associated with higher risk and greater volatility, which can lead to larger fluctuations in the portfolio value. These fluctuations may not be suitable for every investor. For private retirement provision or long-term wealth accumulation, Ginmon strategies are not recommended.

Any questions?

What fees apply?

The standard Ginmon all-in service fee of 0.75% p.a. applies to Ginmon Motive. In addition, ETF costs (TER) are incurred, which are deducted directly from the fund assets by the ETF providers.

How much money should be invested in Ginmon Motive?

We recommend using Ginmon Motive as part of a "Core-Satellite" strategy. The majority of capital investments, usually at least 80%, should be made through long-term manageable "Core" investments.

For this purpose, Ginmon Invest is suitable, for example. Ginmon Motive should rather be viewed as a speculative investment and should therefore not exceed a weight of 20% in the overall portfolio as a "Satellite".

Is an investment in Ginmon Motive suitable?

Investments in certain themes are of interest to anyone who follows current developments or wishes to invest specifically in their interests. In this context, the personal risk profile plays an important role. Ginmon strategies are associated with higher risk and greater volatility, which can lead to larger fluctuations in the portfolio value. These fluctuations may not be suitable for every investor. For private retirement provision or long-term wealth accumulation, Ginmon strategies are not recommended.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

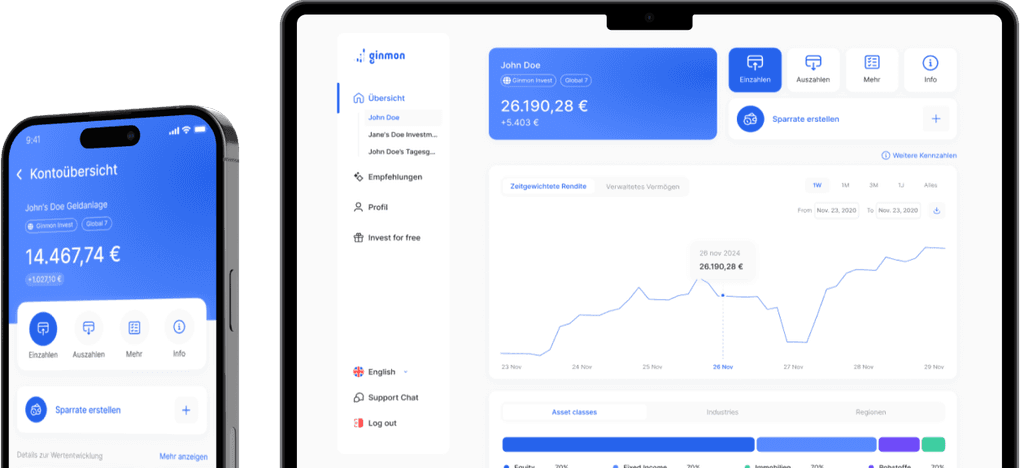

Get the app