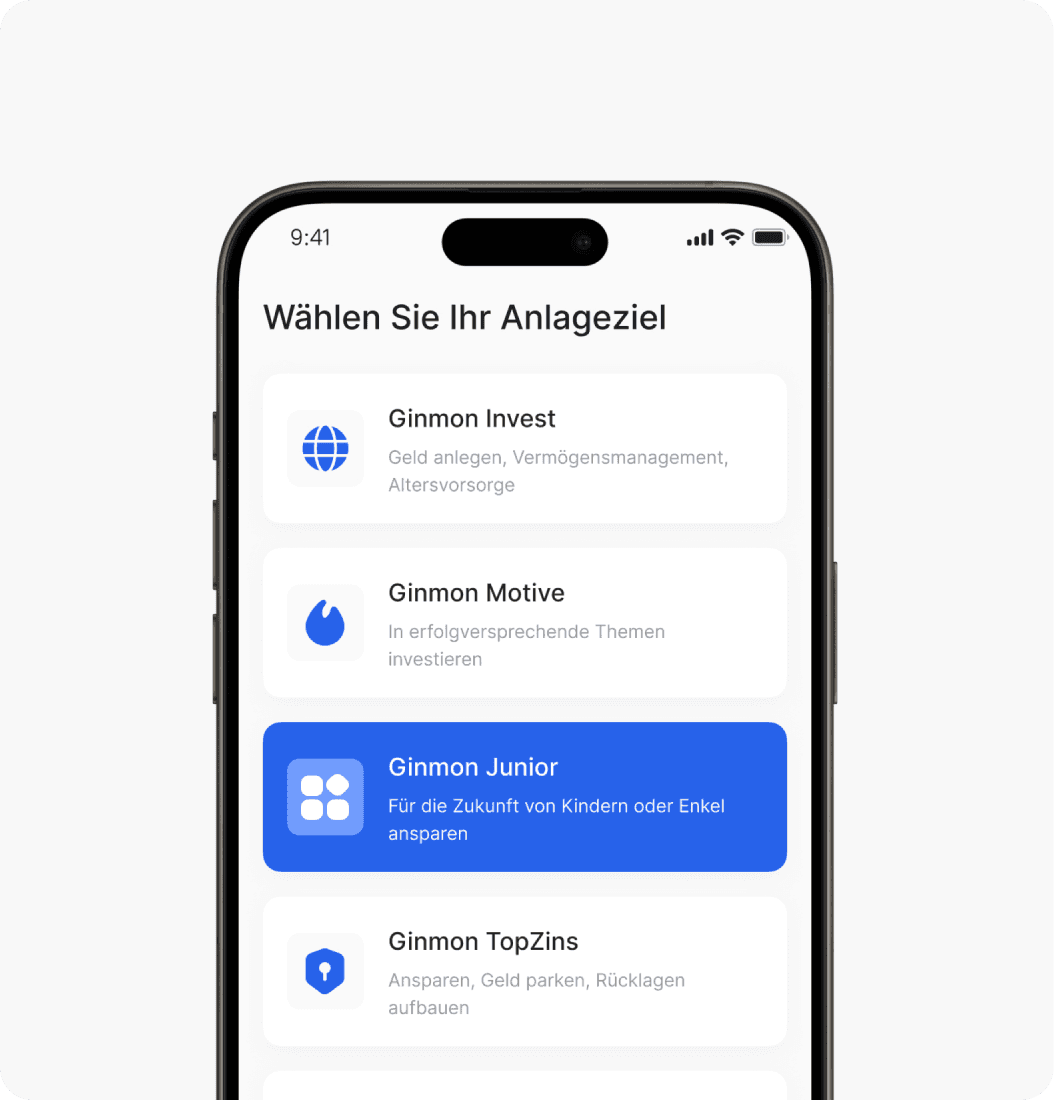

Ginmon Junior

ETF savings plan for children

Tax-efficient and high-yield investments for children

Parents, grandparents, and relatives can contribute

Sustainable ETF strategies available

Those who start earlier achieve more

Average expected return:

8.66% p.a.¹

Investment in equities, bonds, real estate and commodities

Also available as a sustainable option

Automatic risk management

Smart tax optimisation using the annual child allowance of up to €11,944

Grandparents, relatives and acquaintances can also contribute

Service fees starting at 0.60% p.a.

Tax-optimised or full control. You have the choice.

Account in the name of the child

Personal tax allowance of up to €11,944 per year

Child has access to the money from the age of 18.

Legal guardian required to open the account

Account in your own name

No separate child's tax allowance available

Account opening without legal guardians possible

Our investment strategies

Global Investment

Scientific factor investing

Focus on value and small caps

Regional allocation based on global GDP

Green Investment

Stricter sustainability approach

Approximately 60% lower CO2 emissions⁴

Supports UN Sustainable Development Goals⁵

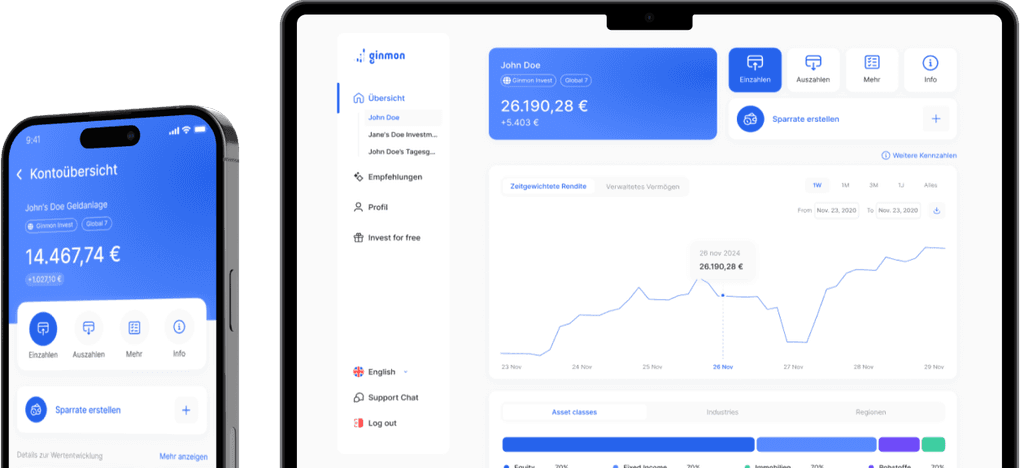

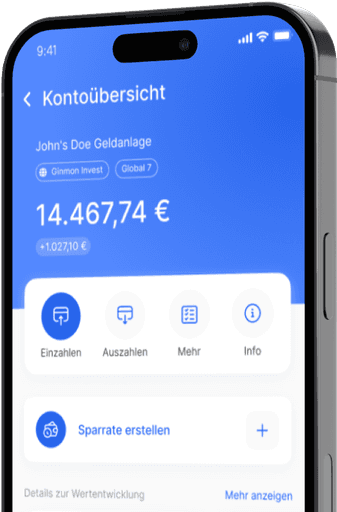

How Ginmon Junior works

² Calculation of the future value based on expected 8.66% p.a. returns of the Global 10 strategy before fees with a monthly savings plan of €90 over 16 years.

³ Calculation of the future value based on expected 8.66% p.a. returns of the Global 10 strategy before fees with a monthly saving plan of €50 over 10 years.

⁶ Customer reviews come from Trustpilot or Google Reviews. Verification is not done by Ginmon, but by the respective review platforms. For more information on how these providers ensure the authenticity of reviews, you can find it here: Trustpilot / Google.