Evidence-based capital investment for maximum investment success

Discover how we combine leading capital market research and technology to achieve optimal investment results.

Discover how we combine leading capital market research and technology to achieve optimal investment results.

Historical returns

Global

Green

Global

Green

Global

Green

Global

Green

Investment strategies in detail

Global

Green¹

Strategy

Expected return

Individual titles

Asset class

Fixed income

Equity

Real estate

Commodities

Money market funds

Investment strategies in detail

Global

Green¹

Strategy

Expected return

Individual titles

Asset class

Fixed income

Equity

Real estate

Commodities

Money market funds

Investment strategies in detail

Global

Green¹

Strategy

Expected return

Individual titles

Asset class

Fixed income

Equity

Real estate

Commodities

Money market funds

Investment strategies in detail

Global

Green¹

Strategy

Expected return

Individual titles

Asset class

Fixed income

Equity

Real estate

Commodities

Money market funds

Factor Investing

We utilize all verifiable sources of income to generate additional returns.

Equity Premium

The equity premium refers to the excess return that investments in the stock market achieve compared to low-risk asset classes such as short-term German government bonds.

Size Premium

The size premium refers to the effect that stocks of smaller companies achieve better long-term returns than those of larger companies.

Value Premium

The value premium describes the effect that companies with a low price-to-book ratio (value companies) achieve higher returns than those with a high price-to-book ratio (growth companies).

Higher returns through smart technology

Our automated portfolio management optimises returns and reduces risks of the investment.

Counter-cyclical investment strategy

Our portfolio management invests counter-cyclically, which means exactly the opposite of herd behaviour. Instead of buying when prices are rising, such asset classes are sold and instead those that have fallen in value are bought. Or simply put: 'Buy low, sell high'.

Active risk management

Due to fluctuations in the markets, investment risks shift. Our active risk management continuously monitors your investments and reallocates to less risky asset classes if necessary.

Automated tax optimisation

If there are any unused saver allowances remaining at the end of the year, our automated tax optimisation will automatically realise capital gains to make full use of exemptions and not let them go to waste.

Truly global

Our investment strategies invest in around 12,000 companies from 103 countries. By comparison, an MSCI World invests in only 1,600 companies from 16 countries.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

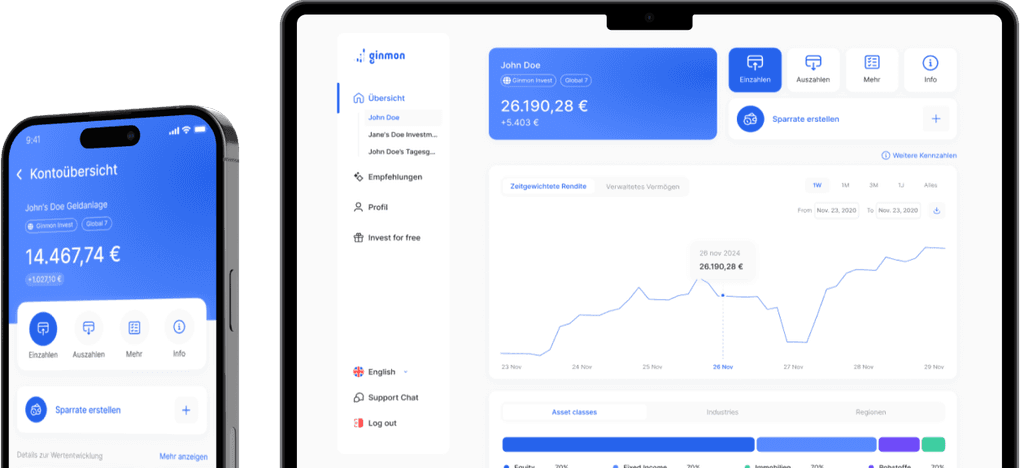

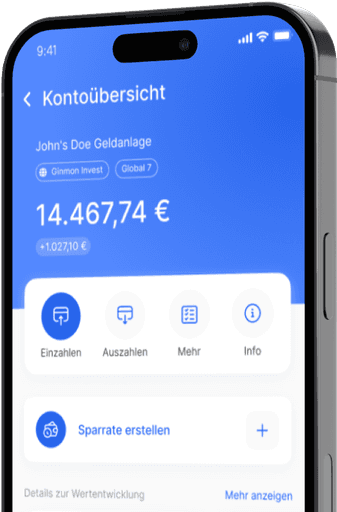

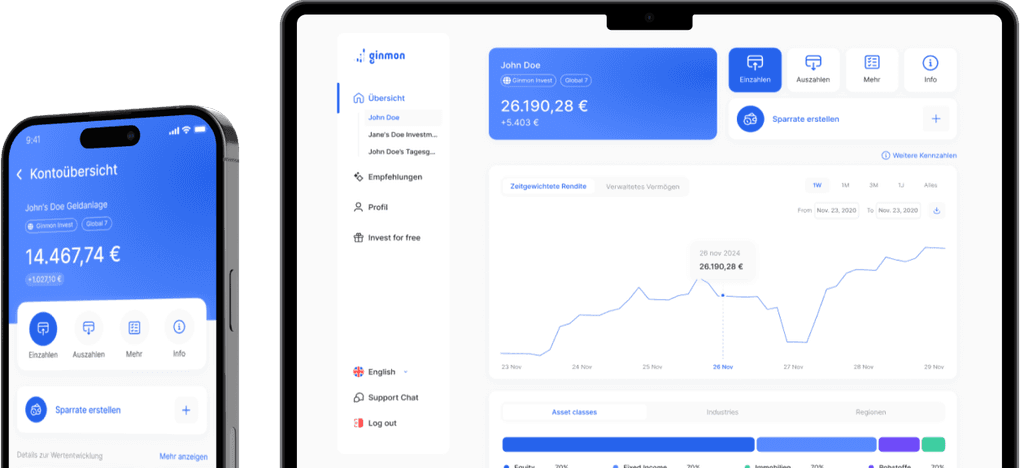

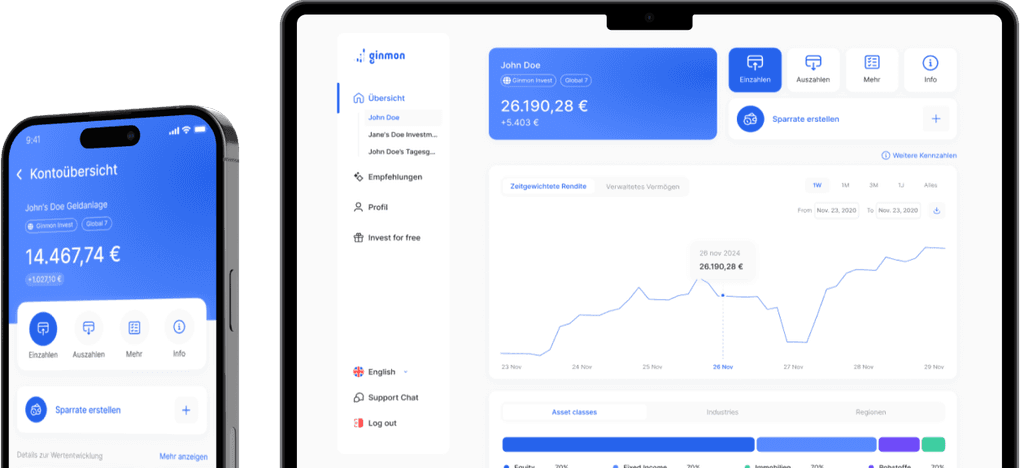

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. Three will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. Three will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. Three will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Other questions?

What is Ginmon?

Spelling: [ɡin moɴ]

Ginmon means "silver gate" in Japanese and is an independent WealthTech (Digital Asset Manager) founded in December 2014, consisting of a team of dynamic IT and finance experts.

Our goal is to provide an independent, automated, highly diversified and highly scientific investment for you, so that you can save money and time. Together we will find the way through the silver gate to the well-deserved prosperity for your financial goals.

“Many people overlook the silver lining because they are waiting for gold.”

(Maurice Setter)

What does Ginmon offer me?

Ginmon offers a transparent and fully automated investment solution that enables you to invest your saved wealth cost-effectively into established investment forms with a clear investment strategy and ease of use.

Through user-friendly technology combined with understandable investment products, Ginmon provides a completely new way of investing.

For more information on our investment strategies, please visit our Investment philosophy.

How does the registration process work?

First, you register and answer 8 questions about your investment goals.

This takes less than 3 minutes.

Now you will receive your personalized investment proposal.

Next, you verify your identity via video ident.

You then tell us how you would like to deposit your money into your custody account.

• via SEPA credit transfer

• via recurring SEPA credit transfer

• via SEPA direct debit

As soon as the money arrives, we invest it in your personalised ETF strategy.

Of course, you can change your strategy or deposit at any time, free of charge, or even have all your investments paid out.

What if I want my money? Do I have to wait?

No, you can withdraw your Ginmon deposit when you want.

You can pause your savings plan as often and as long as you want. No extra fees or lock-up periods.

What if Ginmon no longer exists?

Good question! Let's go through the worst-case scenarios.

Case 1 - Ginmon goes bankrupt.

In this very unlikely case, your deposit would remain unaffected.

The custody account is safely held at our partner bank.

Case 2 - The partner bank goes bankrupt.

Don't worry, this is also very unlikely.

In fact, your invested money is completely protected.

In this case, your securities are held in a so called “segregated account” that, in the worst case, is automatically transferred to a partner bank of your choice. Three will be no change to your account, and you will remain invested.

Case 3 - The capital market collapses.

While capital markets are volatile, this is of less concern to the long-term investor.

The global capital market has, without exception, recovered after every crisis and achieved steady 6-7% p.a. returns over longer period of time.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.

Try it out now

With or without an investment goal. Create a

free investment proposal in just a few minutes.