Our services and fees at a glance

Fair and transparent fees for a professional service.

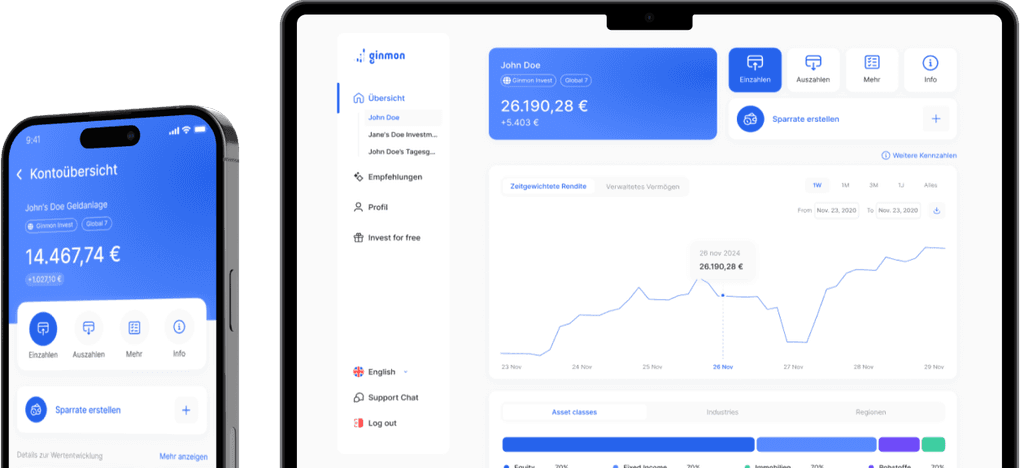

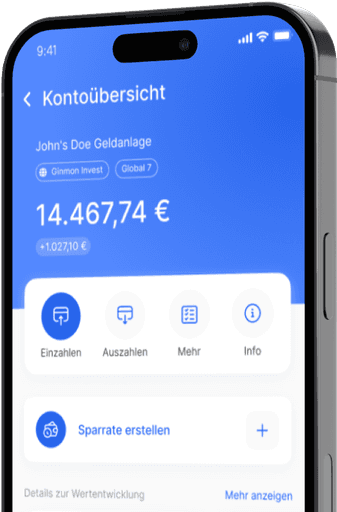

Ginmon

TopZins

All Investments

except TopZins

Transparent costs with tax advantage

daily

monthly

Ginmon service fee excluding ETF costs of 0.75% per annum or 0.60% per annum from €1,000,000 investment

Our service fee covers all costs associated with account management and transactions. This allows us to guarantee a 100% independent selection of investment components without commissions.

Yearly tax savings potential

Service table

Portfolio management

Globally diversified portfolio

Automated smart rebalancing

Automated ETF Optimization

Active risk management

Automated tax optimisation

Consultation & Support

Service hotline

Personal consultation via callback

Depot change service

Personal contact person

External depot check

Financial and retirement planning

Personal

Finance Coach

Goal-based investing with subaccounts

Personalised recommendations via app

Investment tips via newsletter

Quarterly reports

Conditions

Minimum investment

Savings plan

Depot tour

Deposits and Withdrawals

Transaction costs

Change of strategy

Depot facility or closure

Output surcharges or commissions

Performance fees

Kickbacks or rebates

Mindestlaufzeit

Reduced fee (from €1 million)

Internal ETF product costs (TER)