The highest level of security is our top priority

Find out how we guarantee the maximum security for your money

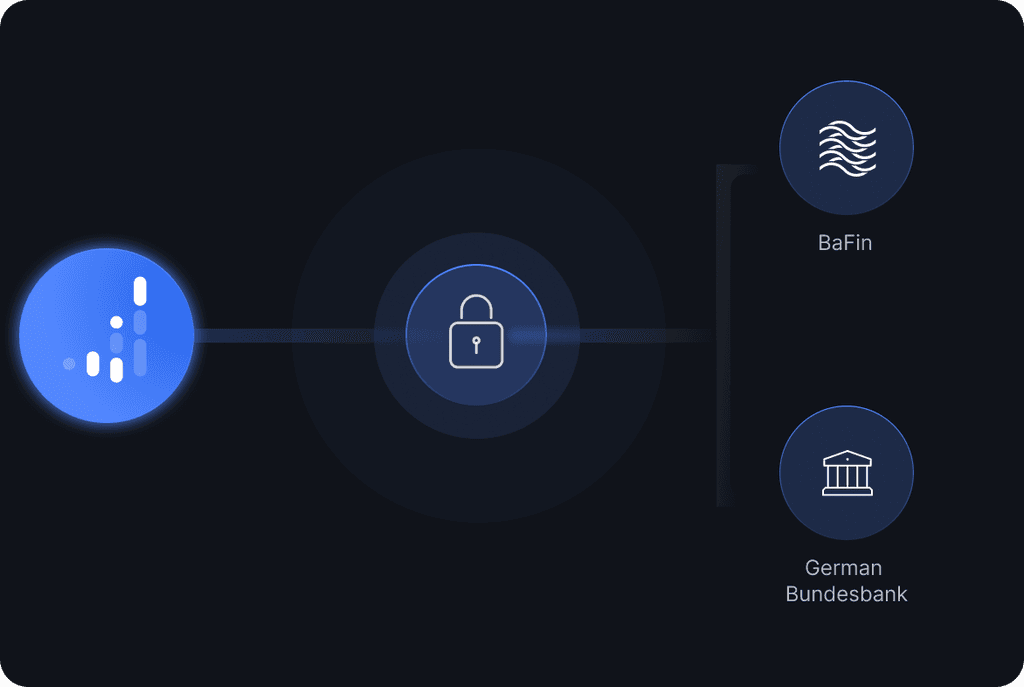

Regulated securities institution in Germany

Ginmon is a securities institution regulated in Germany, licensed and supervised by the Federal Financial Supervisory Authority (BaFin) and the Deutsche Bundesbank. As such, Ginmon is subject to the strictest supervision in Europe.

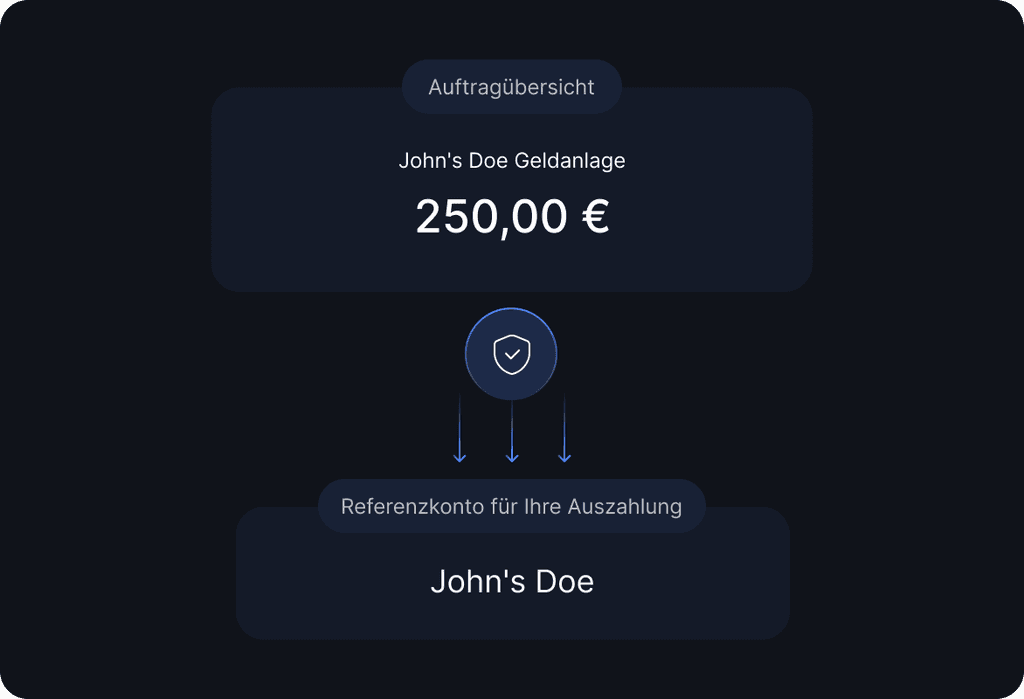

Payouts only to the reference account

Withdrawals from the Ginmon account are only executed to a reference account provided by you, which is in your name. Neither Ginmon nor any third parties have access to your assets.

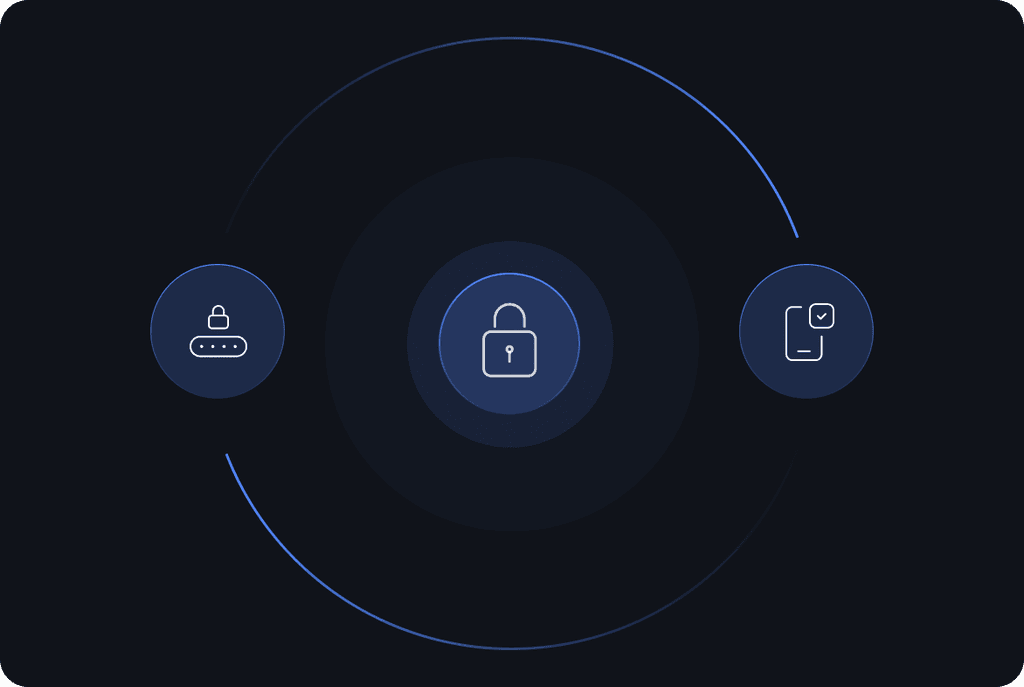

Two-factor authentication

Two-factor authentication ensures that security-related functions (e.g. address changes, reference account changes, etc.) are only possible in combination with your smartphone. Therefore, should your password ever fall into the wrong hands, this serves as effective protection for your account and assets.

State-of-the-art technology on German servers

For maximum security, we use SSL encryption to bank standards. Our servers are located in Germany and all data is subject to the highest German and European data protection standards.

Renowned partner

The safekeeping of your investment and the processing of securities are conducted in cooperation with renowned European major banks as well as top-tier partners such as DAB BNP Paribas Bank, ABN AMRO, Clearstream Deutsche Börse, and Upvest. All partners are subject to strict national and EU-wide regulations that ensure the protection of cash deposits.

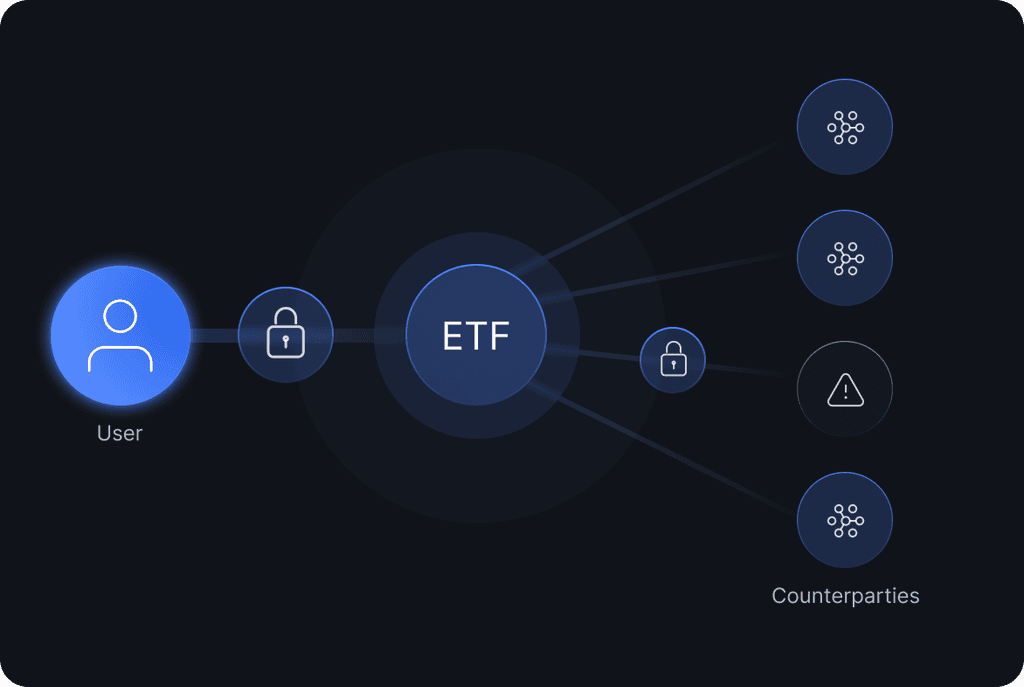

No counterparty risks

Even when choosing ETFs, we prioritize maximum safety. Unless structurally unavoidable (e.g. rolling commodity ETFs), we always opt for physically replicating ETFs instead of swap-based ETFs. Additionally, we only accept minimal securities lending (average max. 20% NAV) with at least 100% coverage within the ETFs.